Want to know your status? Check out this post for the easiest way to calculate your status.

After months of patiently waiting for my status with Chase to drop below 5/24, it finally happened earlier this month. My status actually dropped not to 4/24, but to 3/24. I need to come up with a strategy to apply for their best premium cards and hopefully not get shut down.

First I should inventory the Chase cards that I currently have:

- Ink Plus (Business)

- Freedom (5X rotating categories)

- IHG

- Hyatt

Business Cards

The first card that I ended up applying for was the Chase Ink Business Preferred, this card has been at the top of my list for it’s huge 80,000 point sign up bonus. It’s a card I will probably keep for the cell phone protection alone. I actually used my wife’s referral link so she’ll earn 20,000 points + my 80,000 sign up bonus points + 5,000 spend requirement = 105,000 points!

After I applied I got the ‘we need more time to review your application’ screen. I didn’t panic like some people and automatically call Chase. I just let the application run its course. About a week later I logged into my Chase account online and was happy to see my new Ink Business Preferred card showed up online meaning I was approved for the account.

About a week later I received my card in the mail. I’m currently working on the $5000 spending requirement.

Current Status: still 3/24 since this is a business card

Chase Ultimate Rewards

Chase Ink Preferred Business

- 80,000 Points after spending $5000 in the first 3 months

- 3X points on Travel, Shipping, Internet/Cable/Phone, & Advertising Purchases

- $600 / Claim Cell Phone Protection & No Foreign Transaction Fees

- $95 Annual Fee

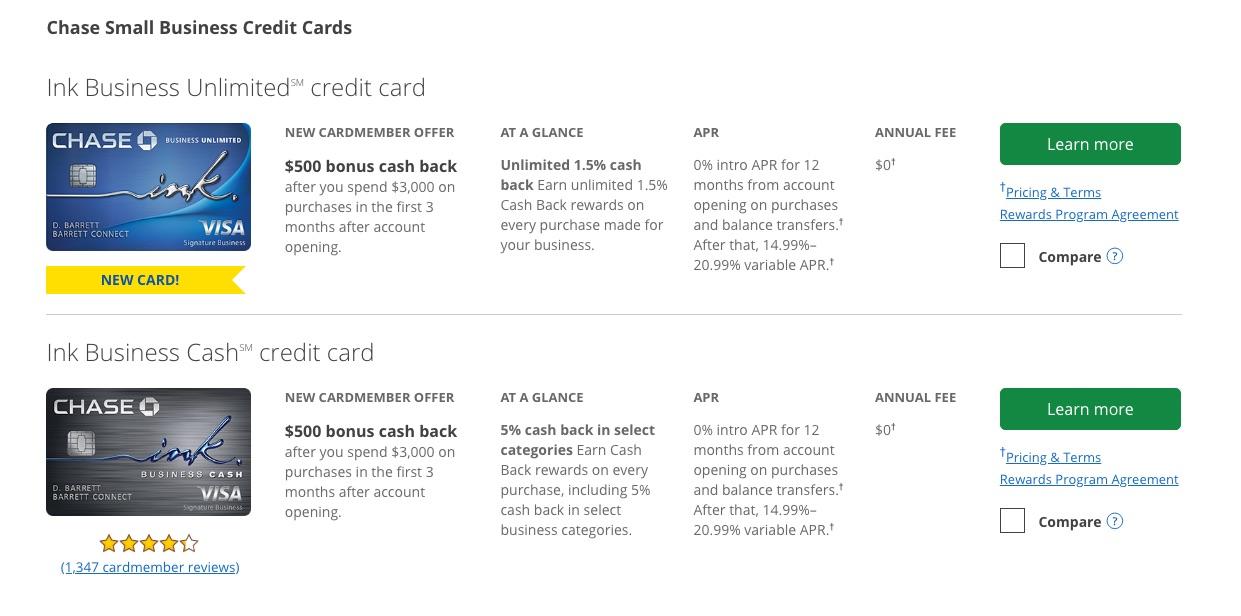

I’ll probably end up applying for the Ink Business Unlimited card since it offers 1.5 points for all purchases since I don’t have the Chase Freedom Unlimited.

Status after one or both of these cards: still 3/24 since they are both business cards

sample offer – current offer may be different

Currently the Sapphire Reserve has a 50,000 point sign up bonus after spending $4000 in 3 months which is not too shabby. I’ll most likely keep this card long term even with it’s $450 annual fee.

First it gives you $300 per year in travel credits which I’ll easily use. It also provides you with a $100 Global Entry application fee credit – I’m due to renew in the next year. I also like the 3X points on travel and dining which I do A LOT of.

Timing is critical for this card since Chase just recently changed the terms of the Sapphire family of cards so that you need to wait 48 months from the time you received the sign up bonus from any Sapphire family card in order to receive a bonus again.

I originally got the Sapphire Preferred in February 2014 and met the spending requirement that same month. So I will have to wait until ~March before applying.

Status after Sapphire Reserve: 4/24

Chase Ultimate Rewards

Chase Sapphire Reserve

- 50,000 Points after spending $4000 in the first 3 months

- 3X points on Travel & Dining

- $100 application fee credit for Global Entry or TSA Pre✓

- 1.5¢/pt value (50,000 = $750) when using Chase Travel Portal

- $450 Annual Fee with $300 Annual Travel Credit

After 6 years, I’ll be losing my Southwest Companion pass. I really don’t have an interest in trying to get it again since that would mean signing up for two more Chase Southwest cards (Business + Personal).

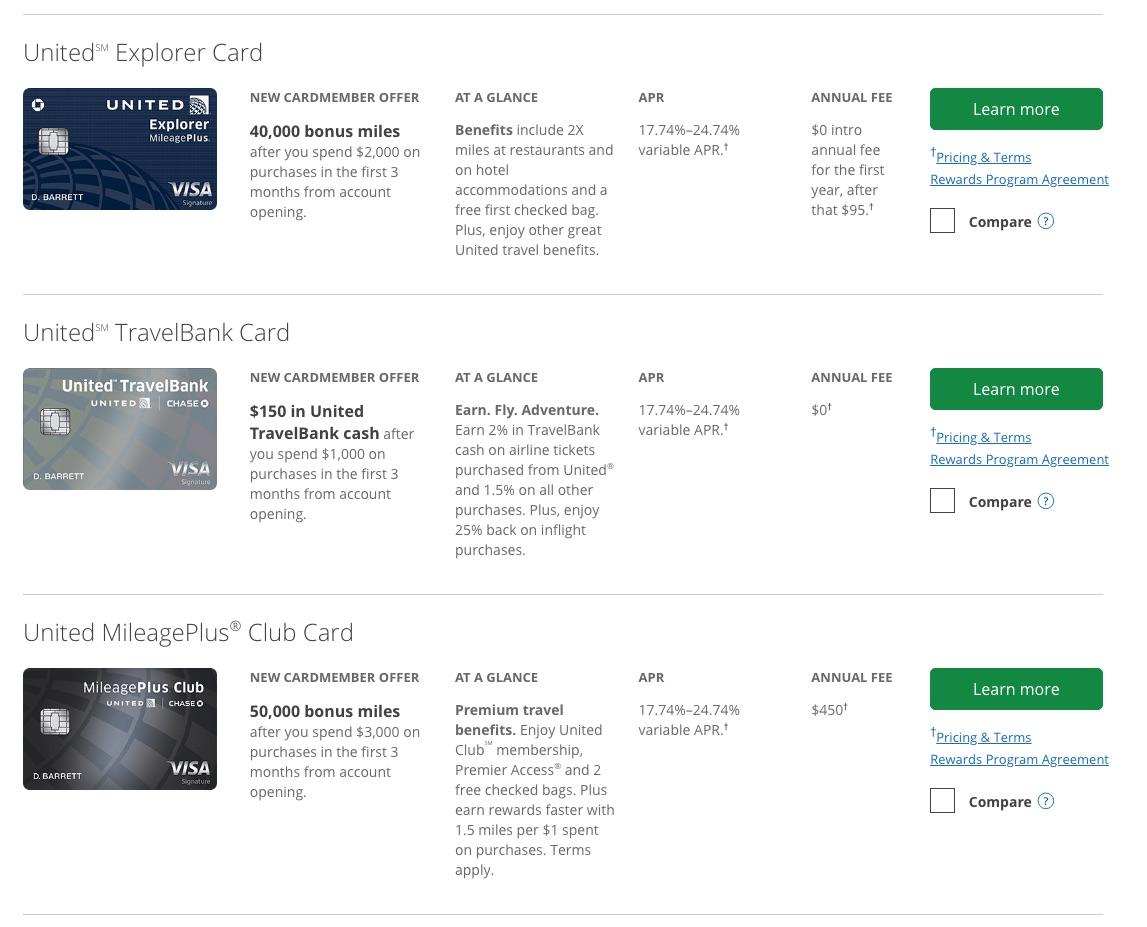

Having the United Airlines card would open up more United award space along with giving us a free checked bag which we’ve become accustomed to with Southwest. Although parking is cheaper at BWI (Southwest hub), I don’t have a problem driving to Dulles (United hub) or Reagan National (American hub) as all three airports are just under an hour drive for me.

But the current sign up bonuses don’t look very appealing – only 40,000 miles with the Explorer card. When it first came out earlier this year, the bonus was 60,000 miles. Hopefully it will increase by the time I am ready to apply for it.

Status after United Explorer: still 4/24 since another card will be more than 2 years old in Feb 2019

sample offer – current offer may be different

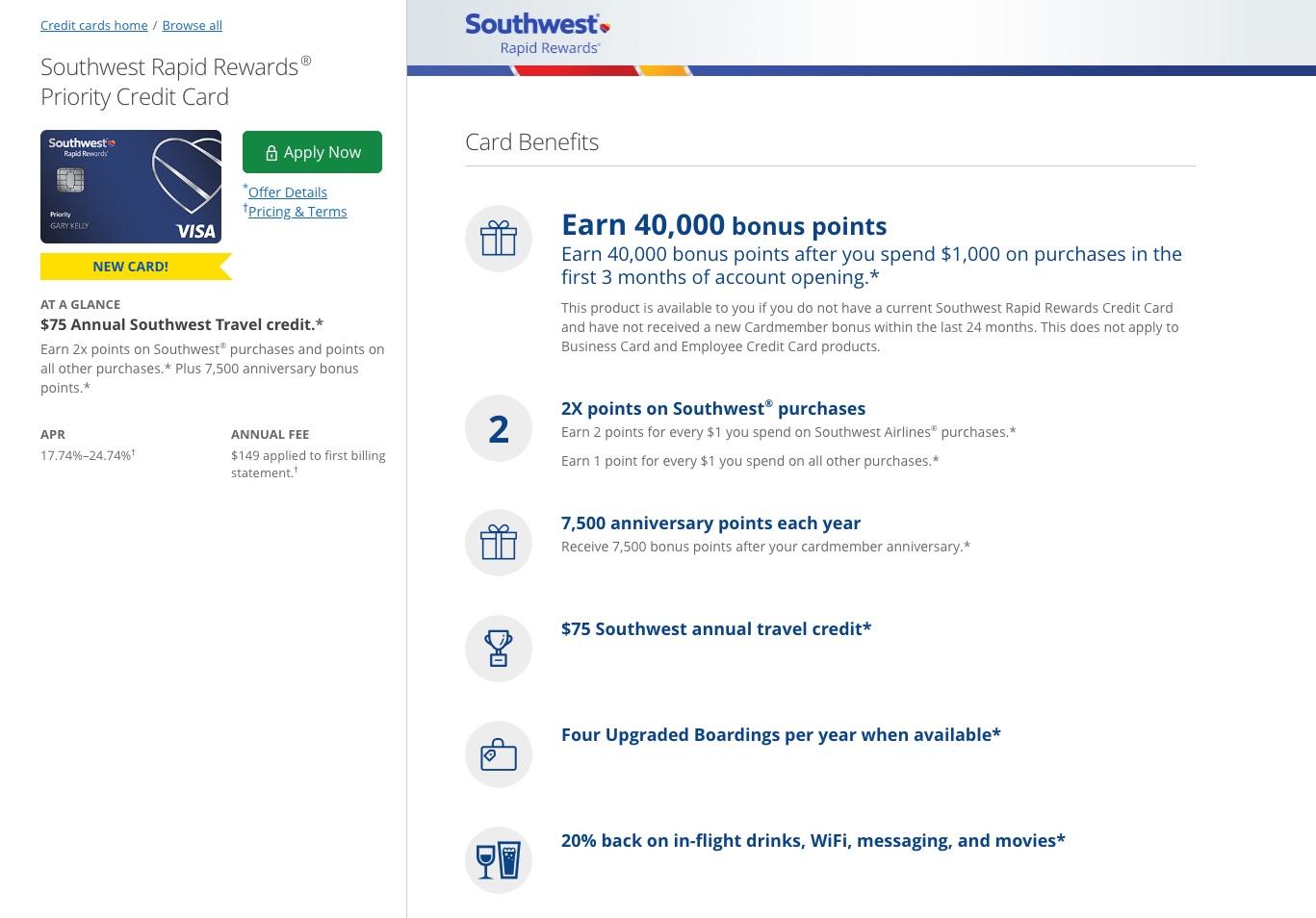

Yes it has a has a $149 annual fee that is higher than normal but it comes with a $75 Southwest annual travel credit – I’m pretty sure buying a $75 give card will trigger the credit, meaning the annual fee is really only $74.

For that $74 you get 40,000 sign up bonus miles and 7500 points each year.

You also get four upgraded boardings each year. Since I usually always buy at least 1 or 2 early bird boardings each flight for our family, this would save me $60/year and get us an A1-A15 boarding position.

Do you think I’d be pushing my luck by trying to get two more business cards?

Are there any personal Chase cards you think would be a better choice?

Thanks for installing the Bottom of every post plugin by Corey Salzano. Contact me if you need custom WordPress plugins or website design.